Inventory valuation methods are an essential part of every business’s costing process. It helps in determining the actual cost per product and profitability. It gives many benefits such as calculating income, financial position and the liquidity analysis of the firm.

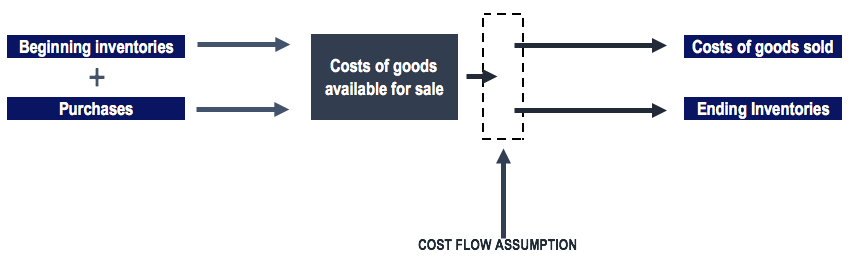

Inventory method helps the business to calculate the cost of the goods sold through this formula:

COGS = Opening Inventory + Purchases + Direct Expenses – Closing Inventory

There are different kinds of inventory valuation methods, and companies follow the process suitable for their management. Some of the conventional inventory processes used are:

- First In First Out(FIFO)

- Last In First Out (LIFO)

- Weighted Average Cost (WAC)

- Specific Identification method

- Retail Method

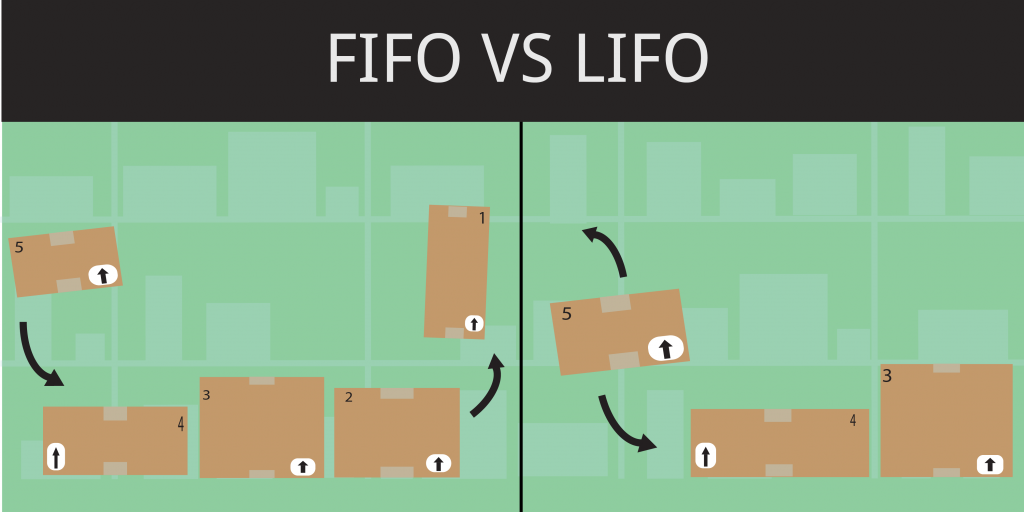

1. First In First Out(FIFO)

FIFO is one of the widely used inventory valuation methods. The principle behind the process is that the materials which came first, are the first to go out. This applies to the purchased or manufactured items. The FIFO is one of the most prevalently used inventory valuation methods worldwide when it comes to perishable items. As companies typically sell their products according to their manufactured date to calculate the actual flow of goods.

For example:

If a business purchased pants at two separate occasions:

200 pants at $30

300 pants at $40

The business sold 150 pants by the end of the month, the FIFO method takes into consideration, the 200 pants purchased at $30. Therefore, the cost of goods sold would be:

COGS= (150 pants X $30 FIFO method )= $4500

Meaning, there are 100 pants still left on the shelves along with the 300 pants worth $40.

So, the value of the inventory would be :

(50 pants X $30)+ (300 pants X$40)= $13500

2. Last In First Out(LIFO)

Last In First Out is the second widely used inventory valuation methods, where the recently purchased items are used for manufacturing. This principle also applies for manufactured goods, and it is an exact opposite to FIFO method. However, when the price of materials increases, the value of the cost of goods is higher. Also, the resulting inventory count is relatively less.

For example:

From the above example, if the business has sold 150 pants by the end of the month, their COGS would be:

COGS= (150 pants X $40 LIFO method )= $6000

As the pants worth $40 will be sold first, the final inventory value will be:

(150 pants X $40) + (200 pants X $30) = $12000

3. Weighted Average Cost(WAC)

Weighted Average Cost method is one of the lesser used inventory valuation methods. It is used by companies that do not have much variation in inventory. It takes a specific period for calculating the average value of the stock. For instance, the same units as toys or stationery items like pencils and so on. The business can assign those inventory units the same cost.

Based on the above example above:

The total number of pants = (200+300)= 500

The total cost of the pants acquired was (200 X $30 + 300 X $40) = $18,000

The weighted average cost of per pant should be = $18000/500 pants= $36/pant

Therefore, if the business has sold 150 pants by the end of the month, then the cost of goods sold is:

COGS = (150 pants X $36 average cost)= $5400

The remaining inventory value is: (350 pants X $36 average cost) = $12,600

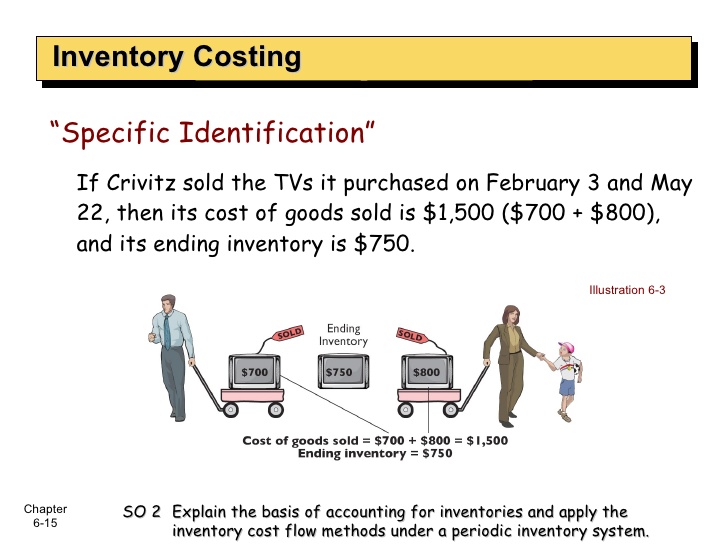

4. Specific Identification method

It is the simplest and least used inventory valuation methods when compared to other methods. By using this process, the firm will attach the exact cost of producing that item to that particular item. Nevertheless, the firm needs to track the item’s price growth right from the start of production.

For example,

A ring costs $110

A bracelet costs $200

A chain costs $500

A diamond ring $ 650

Total inventory costs $1460

By the end of the month, the business has sold:

A ring cost $110

A bracelet costs $200

A chain costs $500

A diamond ring costs $650

Total inventory costs $200

To figure out the profit, the business will subtract the ending inventory cost minus starting inventory cost ($1460-$200=$1260)

This system will limit the business’s functionality and will be hard to track the earnings.

5. Retail method

The retail method uses the factoring the cost to retail price ratio. It is an accounting way of using inventory valuation methods.

- Add the retail value of starting inventory and retail value of products to determine the selling price of products available for sale.

- Deduct the total sales of that period from the retail value of products available for sale.

- Then, calculate the cost to retail price ratio using the formula

- C= A+B

- C+D

Where A= starting the inventory.

B= cost of inventory(including expenses)

C= Retail value of the starting inventory

D= Retail value of the good sold during the period

This method is now out of practice with many businesses worldwide. The advent of modern technologies and inventory practices have shifted the focus to other techniques.

These five inventory techniques are quite useful for business to calculate accurate inventory value of their raw materials and manufactured goods.

Start using ZapInventory today

Start using ZapInventory today