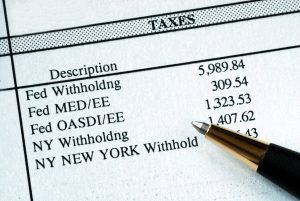

What is an estimated tax?

The IRS annually collects taxes from individuals that earn income. Estimated taxes are collected four times a year. As one’s income gets bigger, his or her tax also increases. The IRS is usually lenient towards individuals who underpay their tax as long as they are able to fulfill at least 90% of their liability. If it’s smaller than that, then there will be penalties incurred.

Who is required to pay estimated tax?

Individuals required to pay estimated taxes are the following:

- United States citizens and resident aliens

- Residents of the U.S. Virgin Islands, Puerto Rico, the Commonwealth of the Northern Mariana Islands, Guam, and American Samoa

- Nonresident aliens

The payment of estimated tax applies to those:

- Who owe at least $1,000 in tax for a specific year after filing your annual return

- Who have a smaller withholding and refundable credits such as

- 90% of the tax declared in your tax return

- 100% of the tax declared on your previous return

- Who owns a business but it is structured as a corporation

- Who are self-employed with an income of at least $400

Take note that there are different applicable rules for fishermen, farmers, and certain household employers and high-income taxpayers.

Special Rules:

- Farmers and fishermen: Estimated taxes for farmers and fishermen would be applicable if two-thirds of their gross income comes from farming or fishing. In this case, they need to pay estimated tax when they have 66 ⅔ % credit from last year’s tax.

- Higher income taxpayers: When your gross salary had been adjusted to more than $150,000 then there would be a need for you to adjust the amount of taxes you pay. You will need to pay estimated tax when you haven’t paid 110% of your tax in the past 2 years.

Who does not need to pay estimated taxes?

Individuals who are able to ask their employers to increase their withholding tax are not required to pay any more. To increase the tax withheld from your income, you need to give out Form W-4 to your employer. You can determine the additional amount that you would like to pay off yourself.

There is also no need for you to pay off estimated taxes when you meet these three conditions.

- If you don’t have any tax liability from the previous year

- You were a citizen of the United States or resided in the country for the whole year

- Your previous income tax return covered 12 months

How do I pay federal quarterly estimated taxes?

After determining the amount of estimated taxes you need to pay, you need to fill up Form 1040-ES, which can be found on the IRS website. There is a worksheet included in the form in order to assist you in your calculations of estimated tax. However, it is not necessary for you to give the IRS the worksheet that you filled out.

The worksheet has an accompanying instruction manual of calculating tax payment you need to make. You will need to make sure that you have a copy of your previous tax return. The instruction manual guides you in what items to be considered as deductibles or credits.

The Form 1040-ES also has four payment vouchers which are used to give out your quarterly payments. This goes with the check or money in an envelope that you would send out to the United States Treasury. The form gives you instruction on where to send out the mail.

There is an option to pay your estimated taxes online, too. You can pay taxes using your credit card, debit card, or electronic funds withdrawal.

When is the payment of estimated taxes?

Payment for estimated taxes is done four times (quarterly) each year. Here is the payment period for estimated taxes:

| Payment Period | Due Date |

| January 1- March 31 | April 15 |

| April 1- May 31 | June 15 |

| June 1- August 31 | September 15 |

| September 1- December 31 | January 15 (the following year) |

If you are going to mail your payment, you must send out the mail with a postmark on the due date. If the due date falls on a Saturday, Sunday, or legal holiday, the payment would still be considered on time if it was sent out on the next business day.

Can you make multiple payments for your taxes?

The IRS allows you to make multiple payments if ever it would be more convenient for you. You would just need to obtain multiple copies of the payment voucher or do the payment online.

When will you incur a penalty?

Individuals are going to be penalized when they make an underpayment from their previous tax return. Penalties would be incurred each day the amount remains unpaid. Penalties will be also applied to those who were not able to pay off their taxes on time.

Taxpayers would not get charged when they only owe less than $1,000 in tax after subtracting their withholdings and credits. Those who don’t receive their income evenly would be able to not get penalized or lower the number of penalties.

There are also two instances wherein penalties would be waived. First one is when you were unable to pay your estimated taxes due to a casualty, disaster, or other unpredictable scenarios. The second one is when you suddenly retired or you become disabled during the year you need to give off your estimated tax payment.

What are other considerations for paying estimated taxes?

- Renewal of individual taxpayer identification number (ITIN)

For people who got their ITIN before the start of the year, or those that have ITIN not declared on a tax return in the last three consecutive years must renew it.

- Standard Deduction

The following will be able to get a deduction on their tax return

| If your filing status is… | The standard deduction would be |

| A married couple filing jointly or a Qualifying widow(er) | 12,700 USD |

| Head of the household | 9,350 USD |

| A married couple filing separately or Single | 6,350 USD |

- The personal exemption amount for certain taxpayers

If you have a gross income below $156,900 then you would be able to get a personal exemption amounting at $4,050.

- Limitation on itemized deductions

The listed deductions of the taxpayers who have a gross salary of $156,900 would have it deducted in their income.

- Social security tax

Individuals that gained an income of $127,200 would be subjected to social security tax.

How should you list down health care coverage on returns?

You can indicate in your tax return that you had your own health care coverage from the previous years. This would give you an exemption from the health care coverage requirement by the government.

If you purchase health care insurance in the Health Insurance Marketplace then you would be getting credits for this. This would reduce the amount of obligation that you have. Just report whatever changes you would have in your salary or the number of dependents.

Final Thoughts

Paying off estimated taxes can be a lot of work. It is up to you how you will fulfill your tax obligation to the government. Just make sure that you pay off the correct amount to the IRS in order to prevent getting penalties. Keep the copy of your previous tax returns as they will serve as a guide for your calculations on the next year. It would not be bad as well to consult an accountant or any tax experts regarding your tax return.

Start using ZapInventory today

Start using ZapInventory today